Textile stocks "glow" thanks to CPTPP

29-01-2018

Japan's Economic Reconstruction Minister Toshimitsu Motegi announced on January 23 that the new TPP Agreement, officially known as the Comprehensive Partnership for Transnational Partnership (PTPP), or TPP 11 - to be signed in Chile on March 8 after two days of trade talks in Tokyo.

Accordingly, Japan hopes TPP 11 will be adopted in 2019 and become a milestone to call for the United States to return and participate in other countries. TPP 11 accounts for 12.9% of world GDP and 14.9% of global trade. "I would join the TPP if we had a much better deal than before," Donald Trump said in Davos.

Meanwhile, Minister of Industry and Trade Tran Tuan Anh also informed the TPP-11 Agreement, with the new name (CPTPP) will be officially signed in March after some problems that need to be negotiated in love. Demand for labor and trade union for Vietnam.

The Minister of Industry and Trade also affirmed that although the CPTPP does not have the US and the benefits are not as high as originally calculated, unobserved benefits come from fostering institutional reforms, creating competitive pressures. for both business and economy. "With progress, it will certainly not stop in the 11 countries that in the future will pull other nations, even in the United States we still believe there is a chance of pulling them back." Mr. Tuan Anh expected.

Recently, Lefaso Vietnam Leather and Footwear Association said that the total export turnover of the whole industry reached nearly USD 18 billion, increasing by 10.7% compared to 2016, the target of export of the industry in 2018 is $ 20 billion. This is because the investment of FDI enterprises in the footwear sector will increase in 2017 to catch up with the effective FTA, the export of footwear in Vietnam in 2018 continued to increase thanks to exports of FDI.

In the textile and garment industry, the export turnover has reached over US $ 31 billion, an increase of 10.23% over 2016. The textile and garment industry also aims to reach US $ 34 billion in export turnover in 2018, up 10% against last year. 2017.

The global economic outlook for 2018 is positive because China continues to focus on reducing investment incentives in the textile and footwear sectors to focus on high-tech industries. Footwear and handbags will continue to shift from China to Vietnam waiting for opportunities from the Vietnam-EU Free Trade Agreement (EVFTA), which is expected to take effect in 2018.

Positive information, textile stocks "headlamp"

Facing expectations and anticipation of FTAs; In particular, CPTPP's very positive information will be signed in March, textile stocks have reacted very well with this information.

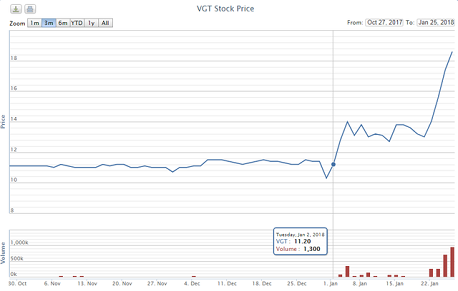

Leading and representing the textile and garment industry, UPCoM (VGT) suddenly attracted investors' attention when it gained more than 66% in the first 18 trading sessions. in 2018; In the past week alone, it has risen 41% and stands at 19,430 VND / share (25/1).

The trading volume of VGT increased sharply from the average of only 38,000 shares per session to over 353,000 shares per session, which was more than 9 times.

The attraction of VGT over time may come from the positive information of CPTPP and FTA. Besides, Vinatex also has positive information from the business results of the group as well as plans to divest.

Specifically, Vinatex said total revenue of the corporation in 2017 is estimated at VND45,550 billion, up 10.7% from 2016. Profit before tax in 2017 reached VND1,434.4 billion, equivalent to last year. In 2018, Vinatex plans to gain VND48,500 billion in revenue and VND1,450 billion in pre-tax profit, up 6.5% and 1.1% respectively from 2017.

In 2018, the Group will also implement the divestment in accordance with the Decision of the Prime Minister so the organization, personnel and management of the Group and the management mechanism of the Group for the member units will gradually change. As planned, the Ministry of Industry and Trade will withdraw 53.5% of Vinatex's stake in this year.

Other textile apparels also showed impressive growth, with the price of 62,420 VND / share (25/1), up 45% in the last month, up by Viet Tien Garment Corporation (UPCoM: VGG). VGG's business results were quite impressive as pre-tax profit exceeded its target after only 9 months with a net profit of VND303.5 billion.

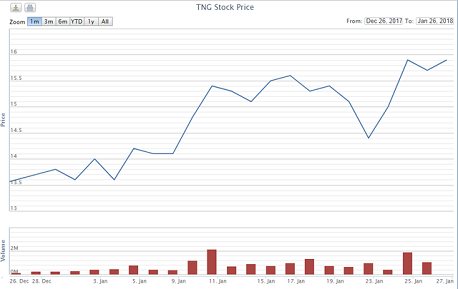

Shares of TNG Investment and Trading JSC (HNX: TNG) have increased 17% in the last month and now traded at 15,700 dong / share (25/1). Trading volume improved from 320,000 shares / session in one year to 952,000 shares / session in the past week, equivalent to increase 3 times in volume.

In addition, TNG shares also benefited from positive business results. TNG's net revenue increased 32% to VND2,489 billion; The company reported gaining 42% y / y to VND115 billion; This means fulfilling and exceeding the annual plan assigned by the General Meeting of Shareholders. TNG's 2017 EPS is VND3,112, with the current price of VND15,700 per share, TNG's PE is trading at 5 times.

Another garment stock also attracted attention was Thanh Cong Textile Garment - Investment - Trading JSC (HoSE: TCM). The information about signing TPP, TCM has immediately hit the ceiling price to 28,550 VND / share, so TCM has increased 111% in the past year.

TCM's business activities have also grown at a good level, achieving net profit of VND 192.6 billion, the highest level since 2011. Compared with 2016, revenue reached VND3,209 billion, up 5% y / y and higher than 67.5% y / y and exceeded our full year target.

In general, textile and apparel stocks have had their last trading day thanks to the CPTPP effect. Besides, the good performance of the textile and garment industry is helping the expectation of textile and apparel stocks to be bright in 2018.

Source Vinatex.com