Vinatex (VGT): Q3's EAT increased 37% YOY

03-11-2017

For the third quarter of 2012, Vinatex posted a profit after tax of nearly VND209 billion, bringing the total after tax profit to VND 512 billion.

Vietnam Textile and Garment Group (Vinatex - VGT) has just released Q3 / 2012 consolidated financial statements with the results of revenue and profit growth strongly over the same period.

Specifically, in Q3 alone, net revenue from sales and services reached VND4,765 billion, up 14% y / y while COGS increased sharply by 18% y / y. sales and services to 378 billion, down 83 billion compared with the third quarter of 2016.

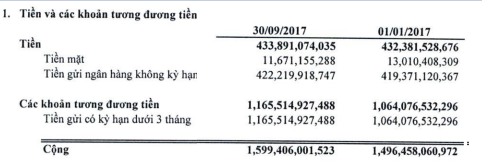

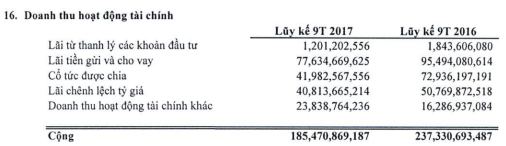

Financial income also fell VND9.6 billion to VND78 billion. In the third quarter, Vinatex posted VND422 billion in non-term deposits. Time deposits of less than 3 months increased by VND 100 billion compared to the beginning of the year to VND 1,065 billion. The company's financial revenue structure, apart from interest income, also includes dividend dividends, exchange rate gains and other financial income.

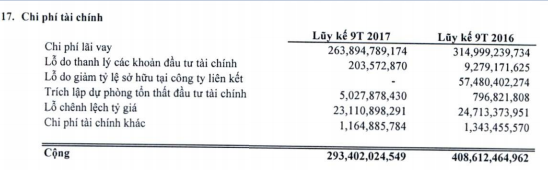

Financial expenses - mainly interest expense incurred in the period 85.6 billion, sharply reduced 56 billion compared with the same period.

Especially, in the third quarter, Vinatex recorded over VND 132 billion profit from associate companies, an increase of nearly VND 80 billion compared to the same period last year. The main reason is that affiliated company Coats Phong Phu has reported a big profit in Q3, recording a profit of VND58 billion for the parent company, an increase of VND46 billion compared to the same period last year.

Selling expenses increased by VND16 billion, while administrative expenses decreased by VND44 billion compared to the same period last year. These factors helped Vinatex post tax profit of VND208.6 billion, up 37% year-on-year.

For the first nine months of this year, net sales were VND13,045 billion, up 15.6% from the same period last year. Of which sales accounted for 98% of total sales. The rest is the turnover of providing goods processing services and rental revenue of real estate.

Total financial income was posted at VND185 billion, down VND52 billion compared to the same period last year. In particular, interest income dropped by VND18 billion, dividend received VND31 billion and exchange difference difference of VND10 billion.

Financial expenses also decreased by VND115 billion compared to the same period last year. In particular, interest expense fell by nearly VND50 billion. Especially, in 2017, it did not record a loss of VND57 billion due to the decrease in the ownership ratio of associates. Loans, bonds issued and short-term financial debt to the end of Q3 is VND4,805 billion, up 780 billion compared with the beginning of the year. Long-term loans also increased nearly 480 billion.

The profit from joint ventures was VND 418.6 billion, an increase of VND 100 billion compared to the same period last year. Mainly thanks to Phong Phu company has announced a large profit.

In the first nine months of this year, Vinatex posted a pre-tax profit of VND576.7 billion, fulfilling 77% of the year target. Profit after tax was VND 512 billion, an increase of 12.5% over the same period of last year, of which the after-tax profit was VND 512 billion.